AI-Powered Client Onboarding Platform for Fintechs

Effortless Client Onboarding, Powered by AI for Fintech Success

AI powered Document verification

Ensure Authenticity, Enhance Security, and Accelerate Onboarding.

Advanced Image Recognition

Using cutting-edge machine learning algorithms, our platform can instantly verify various types of documents—such as passports, driver’s licenses, utility bills, and more—by analyzing images for authenticity, ensuring that the documents submitted are legitimate and unaltered.

Real-Time Verification

Our AI processes documents in real-time, dramatically speeding up the verification process while reducing the risk of human error. This means your clients get onboarded faster, and you get a more accurate picture of their identity and compliance status.

Seamless Integration

The document verification system can be easily integrated into your existing onboarding workflows or platforms, with no disruption to your business operations. Whether you’re using a web or mobile interface, our solution works effortlessly across devices and platforms.

Enhanced Fraud Detection

Our AI continuously learns from new data to detect even the most sophisticated fraud attempts. By analyzing patterns and anomalies, it helps to identify potentially fraudulent documents and flag them for further review.

Safe

Customizable

Hottest tool on the market

Made for Business

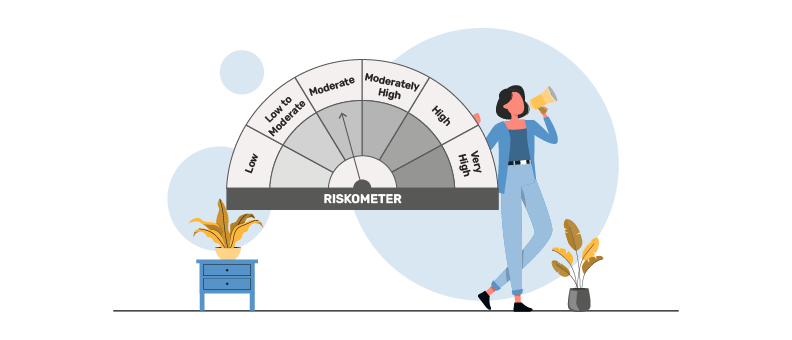

Risk Profiling

AI algorithms assess client risk profiles by analyzing financial behaviors, transaction patterns, and other relevant data points, providing fintechs with valuable insights for better decision-making,

Compliance monitoring

Ensures compliance with global regulations (AML, KYC, GDPR) through real-time monitoring and reporting, helping fintechs stay up-to-date with the ever-evolving regulatory landscape.

Seamless user experience

The platform delivers a smooth, user-friendly interface that guides clients through the onboarding process, reducing friction and enhancing customer satisfaction.

Customizable workflow

The platform offers flexible, configurable workflows to adapt to different business models and regulatory requirements, allowing fintechs to easily integrate it into their existing systems.

What makes us sparkle

What makes us special is our AI-driven platform that simplifies and automates the client onboarding process. We combine advanced technology with customizable workflows to help fintechs onboard clients faster, reduce risk, and stay compliant with ease.

We offer unmatched flexibility and security, providing tailored solutions that scale with your business. With real-time fraud detection, automated compliance checks, and robust data protection, we ensure your business can grow securely and confidently.

Our Goal

Our goal is to empower fintech businesses with effortless, secure, and scalable client onboarding solutions. We aim to streamline processes, reduce operational complexity, and ensure compliance with the latest regulations, all while enhancing customer experience. By leveraging cutting-edge AI and automation, we help businesses grow faster, mitigate risks, and build trust with their clients.

Frequent Asked Questions

Read common queries regarding My Works

What does your platform do?

Our platform simplifies and automates the client onboarding process for fintechs. Using AI and machine learning, we offer features like real-time risk profiling, customizable workflows, automated compliance monitoring, and robust data security, all designed to improve efficiency, reduce risk, and ensure compliance.

How does your platform help with compliance?

Our platform automates compliance checks such as KYC (Know Your Customer) and AML (Anti-Money Laundering), screening clients against global sanctions lists and ensuring adherence to local and global regulations like GDPR. It provides real-time monitoring, risk alerts, and automated compliance reporting.

Is the platform secure?

Yes, security is a top priority. Our platform uses end-to-end encryption, multi-factor authentication, and role-based access control to ensure that sensitive client data is always protected. We also continuously monitor for potential threats and perform regular security audits to keep data secure.

Can the platform scale with my business?

Absolutely. Our platform is highly scalable and customizable to meet the growing needs of your business. Whether you’re onboarding a few clients or thousands, our AI-driven solution adapts to handle increased volume, complexity, and regulatory demands efficiently.

How does the platform improve the client onboarding process?

Our platform automates key tasks, such as identity verification, document checks, and risk assessments, speeding up the onboarding process while reducing manual errors. Customizable workflows ensure a smooth, tailored experience for every client, improving conversion rates and customer satisfaction.

Is your platform customizable?

Yes, our platform is fully customizable. You can design workflows, set compliance parameters, and configure risk profiling to meet your business’s unique needs. This ensures that you can adapt the platform to your specific industry, regulations, and operational goals.

How do I get started?

Getting started is easy! Contact us for a demo or to discuss your business needs, and our team will guide you through the setup process. Our platform is designed to integrate seamlessly with your existing systems, so you can quickly start onboarding clients securely and efficiently.